Update: Late this afternoon, President Trump announced that tariffs on both Canada and Mexico would be paused for 30 days to allow negotiations for a “final economic deal” with the two countries.

A trade war has started, and one of the first battles will be over car prices.

President Trump on Saturday signed an order enacting 25% tariffs on all goods coming into the United States from Canada and Mexico, and a similar 10% tariff on Chinese goods. He paused for one month tariffs on Mexico before they took effect, saying the country had agreed to stricter border control measures. But his order makes the other tariffs effective at midnight tonight, but it makes clear that goods in the country before midnight are exempt.

All three countries promised retaliatory tariffs, though only Canada has explained what it will tariff.

The New York Times explains, “For American families, the likely result is higher prices nearly everywhere they turn — in grocery aisles, car dealerships, electronics stores, and at the pump.”

Some Analysts See Price Increases

Two separate analyses, one from Wolfe Research and one from TD Economics, each arrived at the same conclusion that tariffs will raise the price of the average new car by $3,000. Some will rise much further.

Many cars are assembled in Mexico or Canada. A 25% tariff would mean a price increase overnight.

Cars built in the U.S. will see price increases, too. Those are harder to estimate.

A single car part can cross the border several times in production. Automakers themselves have been reluctant to comment on the tariffs. But American University professor Frank DuBois, who studies automotive supply chains and publishes an annual study on the “most American cars,” says that even tracking where every part comes from could be “a nightmare” for carmakers.

Axios notes, “There’s no structure in place to even place a precise dollar value on all the components that travel back and forth, let alone fill out customs paperwork on them.”

Kelley Blue Book parent company Cox Enterprises also owns Axios.

Other Analysts See Doomsday

Others are less optimistic. Notably, the most alarming comments all seem to come from Canada.

Flavio Volpe, president of Canada’s Automotive Parts Manufacturers Association, told Bloomberg, “The auto sector is going to shut down within a week. At 25%, absolutely nobody in our business is profitable by a long shot.”

Profit rates in the automotive parts industry, he explained, often hover around 10%. The tariff rate is “15% higher than anybody’s profits,” he said. That could make factory closures a logical response.

David Adams, CEO of Global Automakers of Canada, sees the same possibility. He told industry publication Automotive News that automakers and suppliers could halt production. “It’s not something I think that manufacturers will do lightly, but they may be in a situation where the options are relatively limited.”

Linamar Corporation is Canada’s second-largest maker of car parts. CEO Linda Hasenfratz told Automotive News, “I think we will pretty quickly stop making vehicles in North America. Because nobody can absorb this kind of cost. I’m going to say it’s not more than a week before production halts. You can’t make a car unless you have every part.”

Fredrik Westin, CEO of Swedish parts producer Autoliv, said he expects to see companies fail. “Not everyone in the supply chain has the best financial health, and some probably cannot survive very long with the magnitude of tariffs that we are talking about,” he said.

Many Dealers Have Full Lots, for Now

The tariff order specifies that the duties begin “12:01 a.m. Eastern time on February 4, 2025” and do not apply to goods that entered the country before Feb. 1. So, the move won’t directly raise prices on cars on dealer lots today.

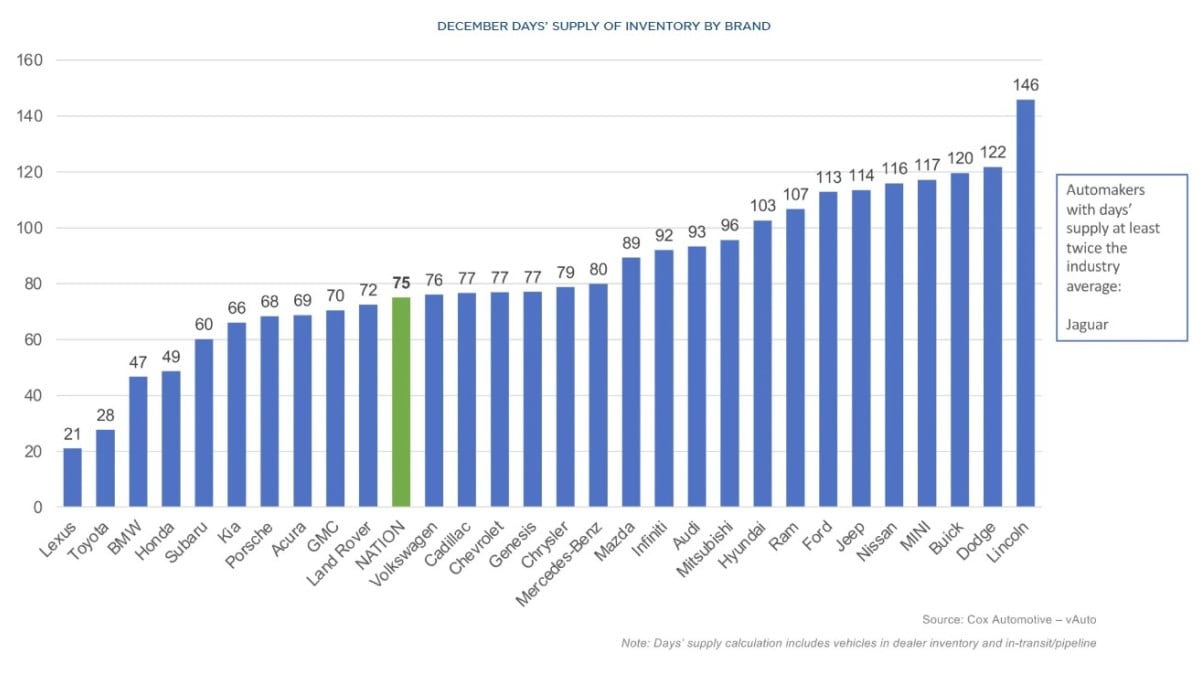

Car dealers measure their supply of cars to sell in a metric they call “days of inventory” — how long it would take to sell out of cars at today’s sales pace if they couldn’t acquire more.

Each dealership has its own inventory practices designed to suit its local community. However, a rough industry guideline means most aim to keep about 60 days’ worth on the lot and another 15 in transit.

The industry ended December with an average of 75 days — precisely on target. But outliers make up that average.

Some brands, including Lexus, Toyota, and Honda, are undersupplied by traditional measures. Prices may rise faster at those, as dealers sell out of cars and order more at post-tariff prices.

Others, including Ford, Nissan, Ram, and Lincoln, are well over the traditional target and could hold out longer at current prices.