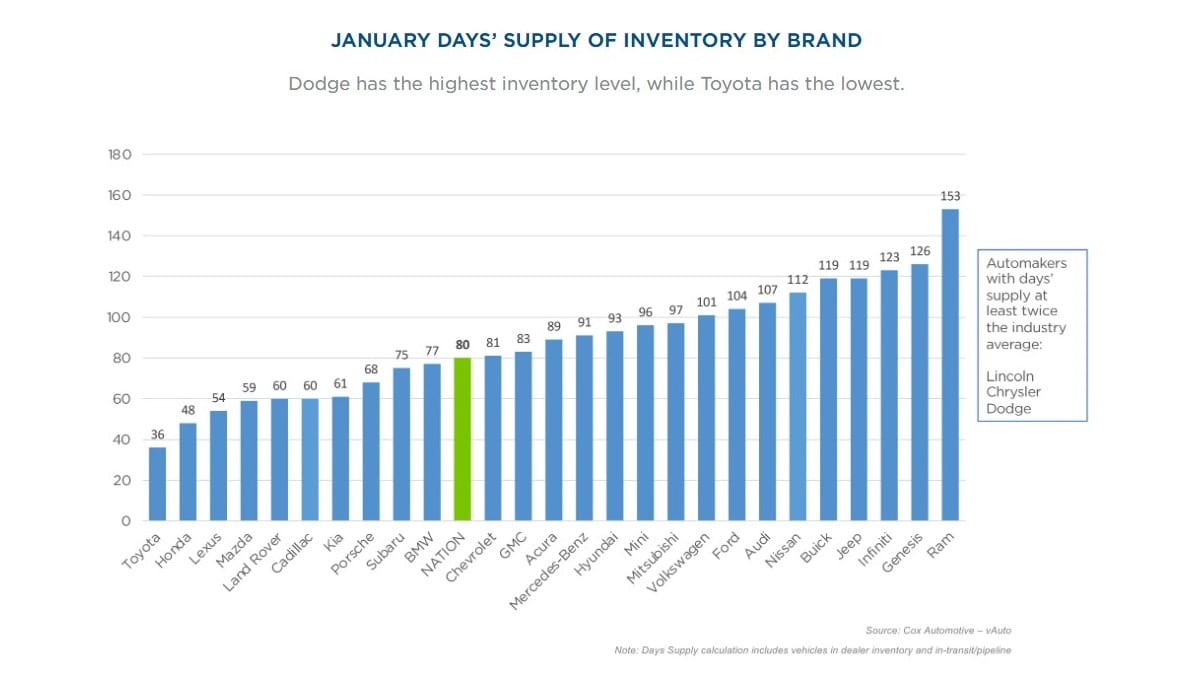

On average, America’s new car dealers have about 80 selling days’ worth of new cars in stock. That’s a problem. It’s a big enough problem that it could trigger significant discounts on some well-known vehicles.

An old industry guideline tells car dealers to keep about 60 days’ worth of inventory in stock. That number, veteran salespeople say, means they likely have the combination of colors and features you want on hand. Eighty is too many. More than 80 is far too many. The current average is 80 and is made up of outliers, meaning that some brands have far more unsold cars than they’d like.

Data comes from Kelley Blue Book’s parent company, Cox Automotive.

Some Brands Still Under; Some Well Over

The price of the average new car is now 3.5% lower than a year ago. You can’t yet walk into any dealership and expect to pay below MSRP. A handful of popular brands remain under the traditional target.

Toyota dealers ended January with an average of 36 days’ worth of unsold cars. Dealers from rival Honda have just 48.

A majority of brands, though, are close to or over the traditional inventory goal. Ram leads them all with a jaw-dropping 153-day supply.

Brands with more than 100 days include affordable makes like Ford and Nissan and luxury marques like Audi and Genesis.

Car Dealers Adjusting To a New (Old) Reality

Americans have long bought cars in a strange negotiating system rarely used for any other sort of consumer product.

Dealers typically don’t own the cars on their lots. They generally make payments on them through a complex loan arrangement, often to a bank owned by the automaker that built the cars. Dealers need to make enough off of each sale to pay their loan and pocket some profit in order to stay in business.

But cars rarely have set prices. Manufacturers charge suggested prices, but dealers and buyers negotiate the final price of each car separately.

Over more than a century, most Americans grew accustomed to trying to negotiate the manufacturer’s suggested retail price (MSRP) down. Both automakers and dealers created discount programs and advertised them heavily, competing with one another by offering bigger and bigger discounts. Their task was to create enough buzz around incentive programs to get you in the door but leave themselves enough room to make profits off each sale.

Then, the COVID-19 pandemic hit and upset the whole system.

Worldwide supply chain problems, capped off by a global shortage of critical microchips, left automakers building fewer cars than the market wanted to buy. New vehicles started selling over MSRP. Discounts disappeared.

Some automakers loved the results so much they said they’d keep the market undersupplied forever. One CEO even toyed with setting no-haggle prices, Tesla style, and ending negotiation forever.

Many dealers agreed. Leaders of the dealership business predicted that the old model of competing to offer discounts would never come back.

It took about two years for it to return.

The news has hit dealers hard. A recent Cox Automotive survey found dealer sentiment about their business near an all-time low.

“Many auto dealers are seeing their profits decline from record highs in 2021 and 2022, and they are feeling the pinch from high interest rates. Their expenses have gone up significantly, and the downward pressure on pricing has cut into their margins,” explains Cox Automotive Chief Economist Jonathan Smoke.

Discounts Gradually Returning

Though dealers may hate to see the return of heavy competition and major discounts, they know how to work in this kind of market.

They’re bringing back the incentives.

A year ago, America’s car dealers had 750,000 fewer cars in stock, and incentives made up 2.8% of the average new car sale. In January, with inventory approaching pre-pandemic norms, discounts were 5.7% of the average purchase. They’ve more than doubled in just one year.

Some brands are breaking out old playbooks. Dodge recently re-introduced a popular program from 2019 that offers buyers $10 per horsepower to move up to a more powerful engine.

There’s still room for discounts to grow. They routinely topped 10% of the average sale price pre-pandemic.

They’re easiest to find, at the moment, on pickup trucks and SUVs. Trucks, led by the Ram 1500, and SUVs, led by the Ford Bronco Sport, had the highest inventory at the end of January.

Of the top-selling 30 models, the ones with the lowest inventory were mostly Toyota and Honda models. The new Toyota Grand Highlander had the lowest, followed by the Ford Maverick compact pickup, which is available as a hybrid. The new Chevrolet Trax was also at the low end.