It could be easy to find precisely the car you want at a fair price this month. Or you could be left paying close to sticker price for the closest thing your local dealership can find.

Which circumstance you find yourself in depends on which model you choose.

After a chaotic summer for the auto industry, some brands find themselves drastically overstocked. Others don’t have enough cars in stock to satisfy every customer.

A Reasonable Average Made Up of Extremes

Car dealers plan their inventory carefully. Each dealership has learned its own lessons about serving its community. However, an old industry rule of thumb tells them to keep about a 60-day supply of new cars in stock and another 15 days’ worth on order or in transit.

Veteran salespeople say too few is costly because potential buyers might go elsewhere to find the combination of features and colors they want.

Too many is costly, general managers say, because dealers generally don’t own the cars they sell. They’re making payments on them through a complex loan arrangement. A large supply of cars sitting unsold drains cash.

Related: Discounts On New Cars 50% Higher Than A Year Ago

The last few months have made planning difficult for dealerships. High interest rates kept many would-be buyers home. That problem may finally ease after a Federal Reserve interest rate cut this week, but dealers believe many shoppers are still waiting out a tense election season.

Many dealerships also suffered a mid-summer cyberattack that prevented them from accessing the software that tracks their inventory.

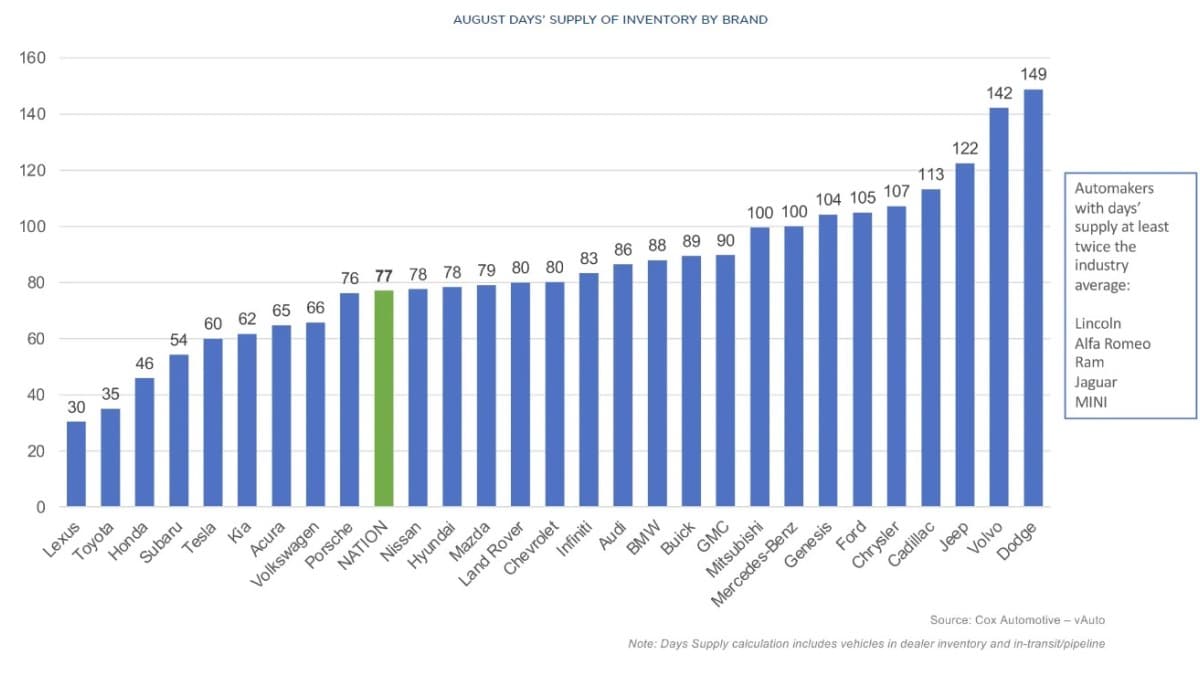

Now that the dust has settled, a few are right on target. The average dealership has a 77-day supply, counting those on order. But many are well north or south of where they want to be.

The data come from vAuto, a company that helps dealerships manage inventory. Kelley Blue Book and vAuto are both owned by Cox Automotive.

Stellantis Brands Among Dealers Oversupplied

One company stands out in the list of those with too many cars to sell. Stellantis — parent company of Alfa Romeo, Chrysler, Dodge, Jeep, and Ram — sees all of those brands with over 100 days.

The situation is dire enough that a group of Stellantis dealers wrote CEO Carlos Tavares in protest, according to the Detroit Free Press. The company responded, disputing the severity of the problem and saying it has begun a plan to fix it.

It’s good news for shoppers, however. It may mean dealers are willing to negotiate.

Other brands with over 100 days of inventory include Mercedes-Benz, Ford, and Volvo. Jaguar and Mini have more than double that 77-day industry average.

Toyota, Lexus Still Short of Cars

At the other end of the scale, Toyota and its Lexus luxury division are nearly as short on supply as they were at the height of COVID-19-related supply chain problems. Honda and Subaru join them on the list of automakers with less than 60 days’ worth of cars.

At those dealerships, shoppers should expect higher prices, lesser discounts, and if they have their heart set on a particular combination of colors and features, a wait to get it.