As news of tariffs that will raise car prices spread, Americans set out to buy the cars still on dealer lots at pre-tariff prices in March. New car prices held relatively steady during the month, but the nationwide inventory of new cars declined significantly.

The average buyer paid $47,962 in March – little changed from February’s $48,039 average price. The expected price increases have largely held off in the early days of the tariffs.

Supply Shrinking

That’s true mostly because automakers already have a supply of new cars in the country at pre-tariff prices. Throughout 2024, many had a significant oversupply. March’s sales pace saw inventory shrink dramatically.

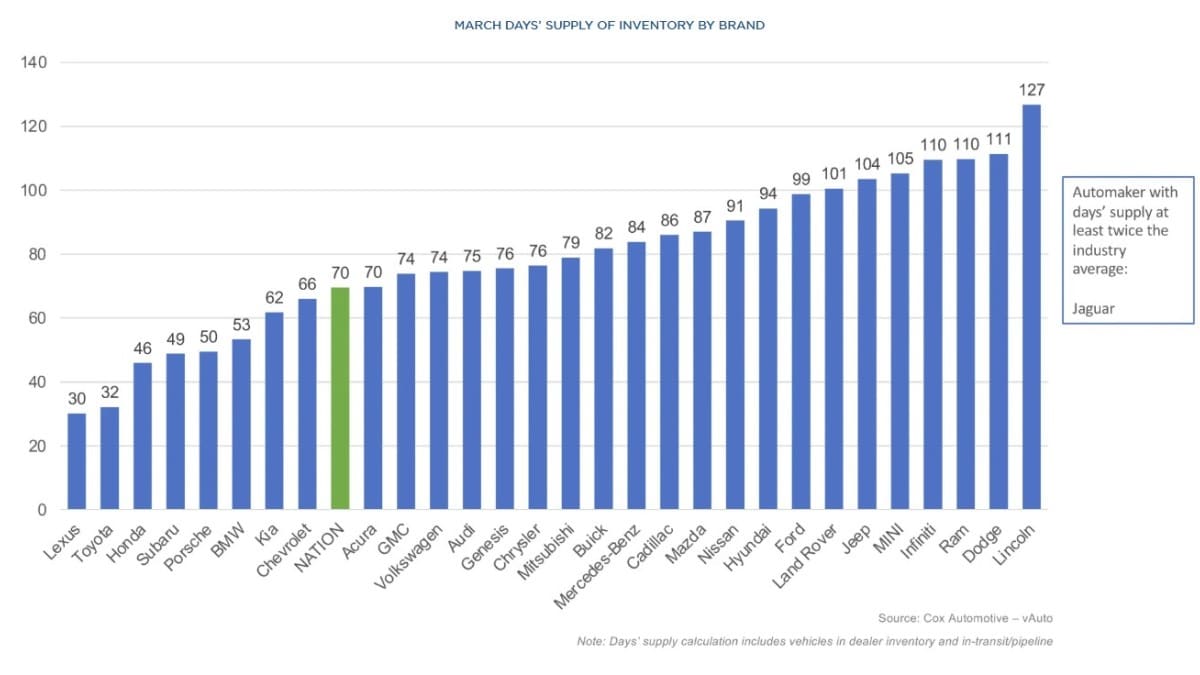

An old industry rule of thumb tells dealers to keep about a 75-day supply of new cars, including 60 days’ worth on the lot and another 15 in transit.

The average dealer entered March with an 89-day supply. They ended it with 70.

That average is made up of outliers. Toyota and its Lexus luxury brand sit at the low end of the scale, with just 32 and 30 days’ worth, respectively. They’re particularly short on popular hybrid models. Lincoln and Dodge hold down the other, with 127 days and 111 days.

Among mainstream automakers, 10 brands saw their supply fall by 30 days or more during the month. Lincoln led all with a 54-day decrease.

Incentives Mostly Unchanged

The tariffs caused automakers to change their advertising, with both Ford and Stellantis (parent company of Chrysler, Dodge, Jeep, Ram, and others) introducing new “employee pricing” deals. But the change, so far, is just a matter of advertising.

Incentives – the discounts automakers and dealers advertise to lure shoppers – stayed nearly flat between February and March. They made up 7% of the average sale, down just 0.2% month-over-month and up just 0.3% year-over-year. The average sale included $3,339 worth of incentives.

Price Stability Not Likely to Last

As dealers sell down their pre-tariff inventory, they’ll have to bring in replacements at post-tariff prices. That means price increases will start to show. Inventory could start to resemble 2021 conditions when COVID-19-related shutdowns and supply chain problems caused automakers to build fewer cars.

But, during the COVID crisis, some American households had more to spend. Federal government relief programs sent checks to most American adults, giving some additional spending power.

Tariffs will likely decrease Americans’ spending power as the prices of many goods rise with no government relief to offset the spikes.

Cox Automotive Executive Analyst Erin Keating explains, “How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%.”

She adds, “Considering the market dynamics, we also anticipate seeing at least a 5% increase in prices of vehicles not subjected to the full 25% tariff. There is no way around it: Tariffs are going to push new-vehicle prices higher in the U.S.”

Cox Automotive owns Kelley Blue Book.