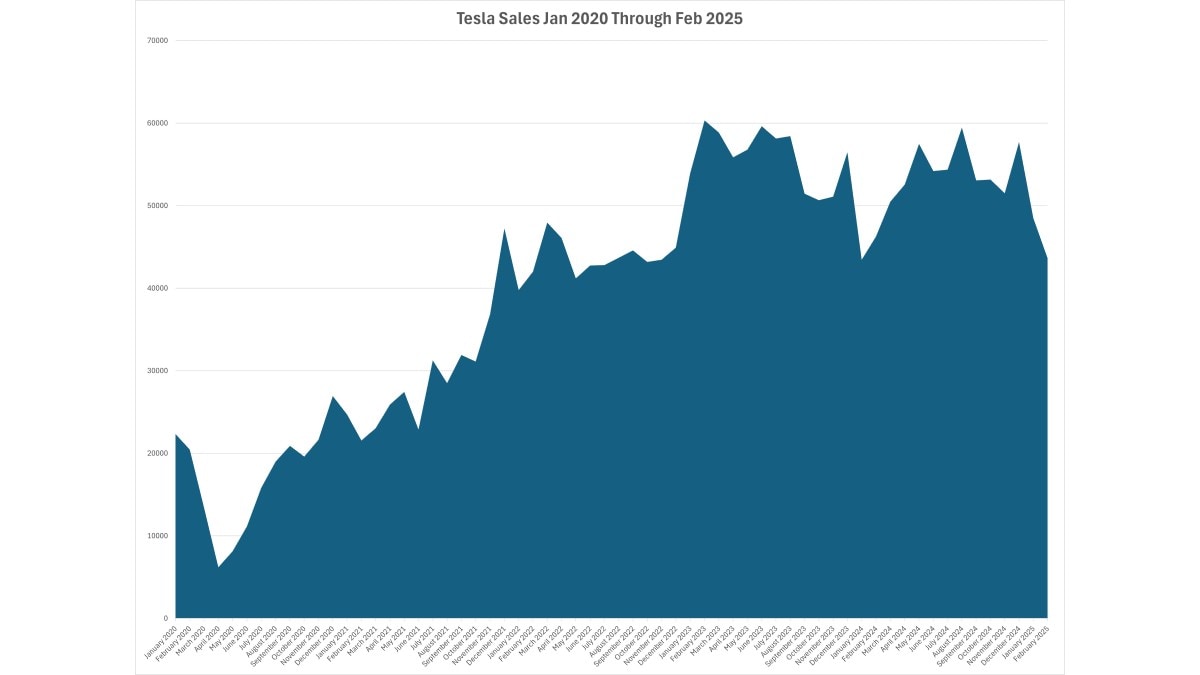

Americans bought 60,325 Tesla electric vehicles (EVs) in February of 2023. The company’s sales have not crossed the 60,000-model line in any month since. Barring a major strategy change, they may never do so again.

New data from Kelley Blue Book parent company Cox Automotive suggest that Tesla’s peak as an automaker came in the spring of 2023. The company has made big splashes since, with the launch of its high-profile Cybertruck and a highly publicized push toward automation. CEO Elon Musk is fond of telling investors that Tesla is now an automation company, not an automaker.

But the company largely built today’s electric vehicle (EV) market, and its signature products are cars. Unless it can change strategy to develop new products with widespread appeal, its high water mark as an automaker may be in the past.

“Tesla propelled the electric vehicle market into the mainstream, setting the standard for innovation. As new competitors emerge and push the boundaries of technology, Tesla now faces significant challenges in maintaining its once-unquestioned dominance, with its market share dropping below 50%,” says Stephanie Valdez-Streaty, Cox Automotive director of industry insights.

Musk has courted controversy with his political involvement, inciting protests at company facilities in Europe and the United States in recent weeks. Sales have slumped worldwide.

It’s impossible to know whether sales would be weakening without Musk’s polemics. But with ever-increasing competition, an aging product lineup, and few public plans for new products, Tesla sales might be in retreat even with a quiet CEO.

A Long Road to Profitability

Tesla Motors was founded in 2003 by Martin Eberhard and Marc Tarpenning. Musk joined in 2004, leading fundraising efforts and taking over as CEO in 2008. The company sold its first car, a high-performance electric roadster based on a Lotus Elise chassis, in 2008.

However, the company didn’t report its first full-year profit until 2020. A federal law and a separate California law require automakers to comply with certain emissions limits and give regulatory credits to automakers that exceed them. Companies that earn the credits can sell them to companies that don’t, helping the latter comply with the law.

For most of its existence, Tesla has made more money by selling regulatory credits to automakers than by selling cars. “Tesla’s strategic advantage has been significantly bolstered by selling billions of dollars in regulatory credits, which have played a crucial role in maintaining its profitability,” explains Valdez-Streaty. “This revenue has enabled continued investment in growth and innovation, remaining a vital component of Tesla’s success story.”

Beyond the Roadster, its earliest products were pricey luxury cars. The Model S sedan and Model X SUV have always been niche products because of their high prices, which have decreased over time.

Sales of the Model S and Model X helped pay for the research and development behind their batteries, motors, and Tesla innovations like “gigacasting,” which builds a car’s structure from several large parts replacing hundreds of smaller pieces.

That business plan — build the luxury vehicles first and add more affordable products as economies of scale pay for the investment — became the model for new EV startups like Lucid and Rivian.

Tesla also pioneered direct-to-consumer sales. It operated its own dealerships in some states. Some states ban that practice, but Tesla found creative workarounds that let it deliver cars ordered online and service them with a fleet of mobile technicians and central locations for more complex work.

A Post-2020 Rocket Ride

As Model S and Model X sales helped pay for expansion, Tesla moved downmarket into more mainstream cars. The Model 3 sedan (introduced in 2017) and Model Y SUV (2020) made it a mass-market automaker.

In 2020, the company surpassed 200,000 sales for the first time. Teslas made up 1.4% of the cars Americans bought that year.

A year later, it sold more than 350,000 vehicles — a market share of 2.34%.

In 2022, it sold more than 500,000, for a 3.76% share of the automotive market. Many Americans came to see the company as synonymous with the rise of electric vehicles. Tesla controlled more than 75% of the EV market in early 2022 as competitors like the Ford Mustang Mach-E began to arrive.

Sales topped out in 2023 when Tesla sold more than 670,000 vehicles in the U.S., and its share of the U.S. automotive market peaked at 4.29%.

To put the numbers in perspective, Americans routinely buy more than 750,000 Ford F-Series pickups each year.

But Tesla appeared set to continue its march toward an affordable, mass-market EV, with investors buzzing about plans for a sub-$25,000 Model 2. After several years of delays, it launched the Cybertruck to the biggest buzz the automotive market had seen in decades.

But 2024 changed everything.

Intensifying Competition

Tesla had proven the market for electric cars. The company had built a massive nationwide charging network, its Supercharger system, that dwarfed all other EV charging networks combined. But, with the market proven, competitors emerged by the dozen.

Traditional automakers moved into the EV business. Tesla faced more competitors every month. Many were compelling, interesting cars.

In 2023, Hyundai’s distinctive Ioniq 6 electric sedan won the World Car of the Year award. In 2024, corporate cousin Kia took the same prize with its EV9 SUV.

Some used an 800-volt architecture that lets them charge faster than Tesla’s 400-volt technology. Many enjoyed the support of large, nationwide dealership networks that made getting service and repairs easy.

Canceled Plans

Tesla, meanwhile, made some significant strategy changes. Musk canceled plans for the Model 2. He backed away from a long-discussed plan to cast cars from a single piece.

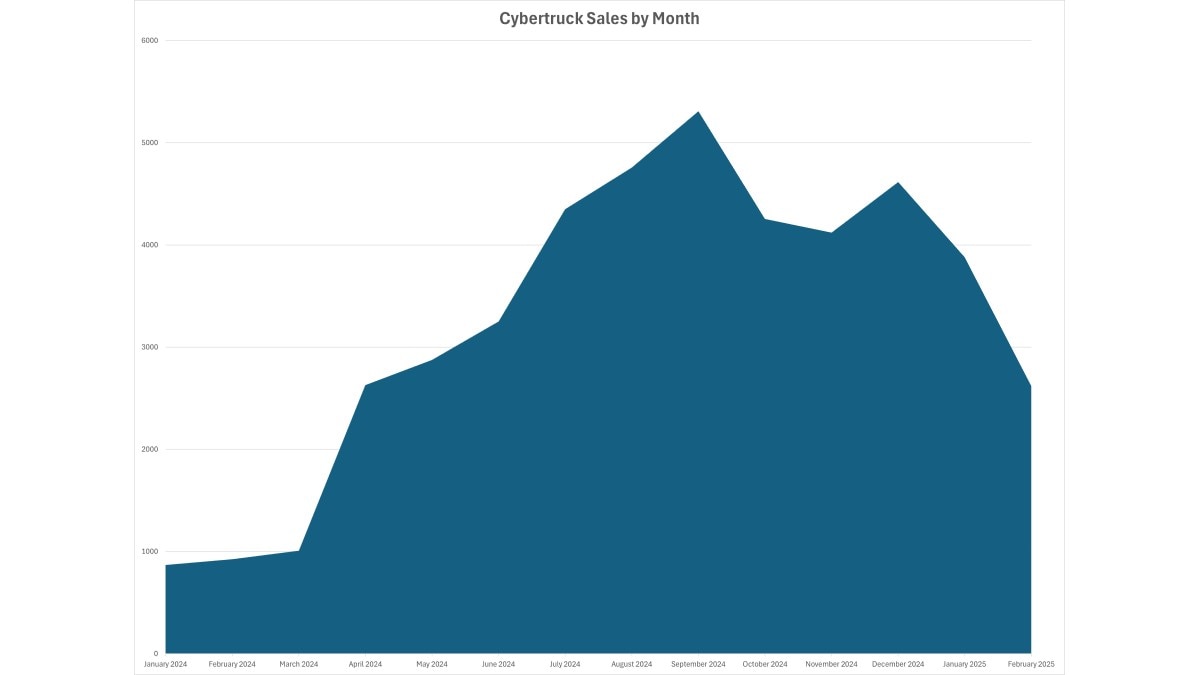

The Cybertruck won attention but not sales to match. Tesla fans had reserved more than a million copies of the future-funky pickup. But buying a reservation required only a $100, fully refundable deposit. Most reservation holders never bought a truck. Cybertruck sales peaked at just 5,308 last September.

The company quickly found itself removing special-edition Foundation Series badges from unsold Cybertrucks in hopes of selling them at lower prices.

Tesla may have also given up a key competitive advantage when it agreed to open its Supercharger network for use by other brands’ EVs.

Until recently, Tesla had its own proprietary EV charging plug. Other brands used a different plug found on fewer public chargers. The Supercharger network functioned as a walled garden available only to Tesla owners.

But, in late 2023, Tesla agreed to open its system for other automakers to use. By the end of 2024, virtually the entire auto industry had signed on to switch to the Tesla charging port. That simplifies life for future EV buyers, who will be able to use any public charger just like owners of gas-powered vehicles can use any gas station. However, this meant that Tesla could no longer count on easy Supercharger access as a competitive advantage to help it sell cars.

By the end of 2024, the trend was clear. Americans bought a record number of EVs that year — more than 1.3 million — but fewer than half were Teslas.

Tesla suffered its first-ever year-over-year sales decline, selling just over 590,000 vehicles in the U.S. Its share of the overall automotive market fell to 3.95%.

Globally, it lost its EV sales crown to a rising threat from China’s BYD.

A Risky Bet on Automation

By late 2024, Musk had taken to telling investors that Tesla was no longer an auto company.

Instead, he said, the company’s future lay in its automation projects. Musk had long promised that Teslas would someday drive themselves. The same technology behind its “Full Self-Driving (Supervised)” driver assistance system could help power its Optimus humanoid robots, he routinely says.

With the Model 2 canceled, Musk instead focused on a promised Robotaxi and larger Robovan that could shuttle passengers around cities without human drivers.

Tesla is not the first company to attempt a robotaxi project. Notably, rival General Motors shut down its Cruise robotaxi division in 2024, finding it difficult to profit with driverless taxis.

Many industry analysts are skeptical that Full Self Driving (Supervised) will be able to power a robotaxi fleet. It’s not the most advanced of its kind.

The auto industry uses a 5-level system to classify automation systems. Most automakers now have Level 2 technology, like Tesla’s Full Self-Driving (Supervised). Only Mercedes-Benz has a Level 3 system that legally allows drivers to look away from the roadway. That system is permitted only in Nevada and parts of California.

Honda has a Level 3 system for sale in Japan, and BMW offers one in Germany. Stellantis, parent company of Dodge, Jeep, and other brands, recently showed off its own Level 3 system, not yet offered for sale. Tesla’s effort remains a Level 2 system, and one of many.

We’re aware of only one major consumer-based study of automation systems. Consumer Reports testing found Ford’s BlueCruise system the best, ranking Tesla’s efforts eighth among major automakers.

A Stale Lineup

In 2025, Tesla offers just five vehicles for sale. All are aging by automotive industry standards. The Model S and Model X ride on a platform introduced in 2012 and have seen mostly cosmetic updates since. The Model 3 and Model Y are newer, using a 2017 platform. But recent refreshes to both have remained mostly visual.

The Cybertruck is Tesla’s only 800-volt vehicle and appears to be a niche product. Finding a niche and filling it is a successful business model, but one that necessarily limits growth.

The company appears to have few new cars in development. Musk still says an oft-delayed Roadster revival could appear in 2025. But, with a reported $250,000-plus price tag, it won’t be a high-volume product that returns Tesla to sales growth.

An analyst from Deutsche Bank said in December that a low-priced “Model Q” is in the works. However, Tesla has not confirmed the plan, and we’ve seen no signs of a new car being developed. With no new platform coming, Tesla watchers believe the vehicle may be a Model Y or Model 3 variant with an inexpensive, lower-range lithium-iron-phosphate battery.

Slump Might Be Happening Without Musk

Amid all these challenges, Tesla sales are falling even in its home market. January of 2025 was Tesla’s worst sales month in nearly a year. February of 2025 was worse. The company sold just 43,650 cars in the U.S. last month — worse than any other month since July of 2022.

We can’t separate Tesla’s sales from Musk’s controversial politics. Global protests may well be driving the sales slump.

But, with a stale lineup, more competition than ever, no new high-volume products in the pipeline, and the loss of its walled garden charging network advantage, Tesla might be seeing a similar sales drop even with someone less controversial in charge.

“Tesla’s early entry into the market has positioned it as a leader in the EV race. As the automotive landscape evolves with both established and emerging competitors, Tesla’s resilience and innovation will be the true test of its enduring legacy,” says Valdez-Streaty.

In the automotive industry, she adds, “Success hinges on delivering the right product at the right price with exceptional customer experience.” With few new products and no compelling new affordable model planned, Tesla would be in a challenging position even without Musk’s controversies.

The protests further complicate that picture. “Many consumers are also influenced by a brand’s values and image,” she notes. “The manufacturers that excel in these areas will stay relevant and succeed. Only time will tell if Tesla can sustain its leadership and continue to shape the EV industry.”

Perhaps Tesla can reshape itself as something other than a car company. But, with its current limited product plans and public image struggles, it’s possible that peak Tesla came in February of 2023.