Quick Facts About New Car Prices

- New car prices continue to edge higher, and incentives are showing a dip after September’s record highs.

- Cox Automotive’s Erin Keating says consumer demand continues to be strong, and the industry continues to respond with incentives and product mix shifts.

- End-of-year timing favors deal-hunting as 2026 inventory continues to arrive and dealers make room for new models.

If you’re in the market for a new vehicle, don’t expect steep price drops anytime soon. The good news: Prices aren’t climbing as high as feared, even with tariffs in play. Industry experts expected a surge in prices due to lower inventory, fewer incentives, and added tariffs. While a sharp spike hasn’t happened, new car prices are edging higher as 2026 models continue to roll in and automakers work to offset higher costs.

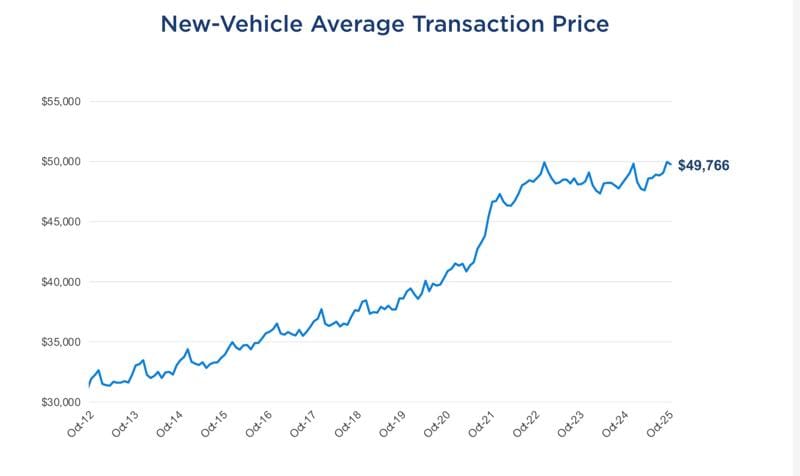

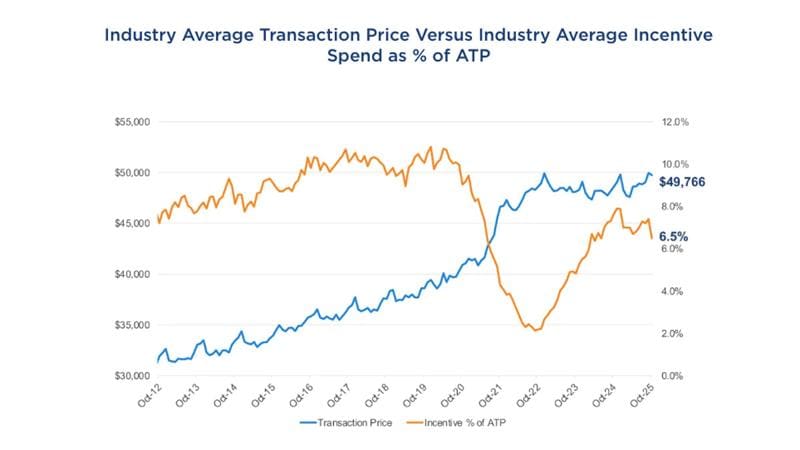

Data from Kelley Blue Book parent company Cox Automotive shows that after reaching September 2025’s all-time high, the average transaction price for a new vehicle did decline slightly to $49,766 in October 2025. The average manufacturer’s suggested retail price (MSRP) for new vehicles in October was $51,841, down slightly from September’s record but up 2.6% year over year. Despite higher prices and market uncertainty, consumer demand remains strong.

Read on for expert insights into what’s driving the current trends and what you need to know if you’re planning to start your search or buy a car now.

- New Car Prices Increase Modestly

- New Car Inventory Update

- Shop Around for the Best Offer on Your Trade-in

- The Higher Costs of Car Insurance

- What to Expect: Looking Ahead

New Car Prices Increase Modestly

Sales slowed in October and November, but the new vehicle average transaction price (ATP) was $49,766 in October, down 0.4% from September’s high. It rose 2.6% from a year ago.

Incentives also saw a dip in October, with an average incentive package equal to 6.5% of ATP. This was a decrease of 11.4% compared to September, where incentive spending equaled 7.3% of ATP. Last year at this time, the average incentive package equaled 7.6% of ATP. “October’s dip in average transaction prices was anticipated and reflects a natural market adjustment after September’s record highs,” explained Cox Automotive Executive Analyst Erin Keating.

“Even with the pullback, prices remain elevated year over year. Fortunately for automakers, there is continued strength in consumer demand,” said Keating. “Consumers remain engaged, and while affordability challenges persist, the industry is adapting with incentives and product mix shifts. We’ve been anticipating a slowdown in the market. This is a story of moderation, not retreat.”

The volume-weighted ATP reflects all the car market realities, including high-volume vehicles, like pricey pickup trucks, influencing the number. For example, full-sized pickups averaged $66,462 in October.

Electric vehicle (EV) prices edged higher to an estimated $59,125 in October, up 2.3% year over year. The expiration of the popular federal $7,500 tax rebate in September contributed sharp 48.9% month over month EV sales drop. The nation’s largest EV seller, Tesla, saw ATP drop 5.5% year over year to $53,526, with its U.S. EV market share declining to 23.6%.

“We expected this shift in the electric vehicle market. With the IRA-backed sales incentives gone, lower-cost EV volume was hit hard, pushing the mix toward more luxury and driving October’s EV ATP to a 2025 high of $59,125 — now $9,359 above the industry average,” said Cox Automotive Senior Analyst Stephanie Valdez Streaty. “Affordability has always been the core challenge with EV sales, and this reset only underscores how critical it is to bring more attainable EV options to market.”

What Drives New Car Prices

- Inventory availability

- Manufacturer incentives

- Dealer discounts

- Trade-in vehicle value

New Car Inventory Update

According to Cox Automotive’s vAuto Live Market View, new car inventory is steady at year-end as inventory slowly climbs. Dealerships began November with an 88-day supply of vehicles, a 4.2% increase from September, but still 5.7% below last year’s levels.

Dealerships track the number of new vehicles they have on hand to sell using a metric called “days’ supply,” or how long it would take them to sell out at today’s sales pace if they stopped adding new vehicles.

If you’re out shopping right now, you’ll likely find plenty of vehicles from Lincoln, Jeep, Ram, Audi, and VW, though you’re less likely to find the exact model you may want from Lexus, Toyota, and Honda. Those carmakers have fewer vehicles in stock at dealerships overall.

As next-model-year vehicles continue to pour in, dealerships need to push out the 2025 vehicles. It may be until early 2026 before we see substantial price increases from the cost pressure on automakers due to tariffs.

Shoppers should closely monitor dealership pricing amid fluctuating tariffs. While automakers set the stage for pricing, dealers ultimately close deals. They might add markups or fees to offset tariff impact.

For now, we suggest shoppers search for cash-back incentives and expand their shopping boundaries to find the right deal for their budget. Low-interest-rate offers and lease deals may be available for qualified buyers as dealerships continue to make room for 2026 inventory.

Shop Around for the Best Offer on Your Trade-in

Trade-in value is another factor driving car prices. A lack of used vehicle stock has kept those prices higher, giving credence to the idea that buying a new vehicle could sometimes be cheaper than purchasing a certain used model, only a few years old. As a result, it’s still a great time to trade in your car.

Dealers value your trade-in partly based on what they need in stock. On the flip side, they’re more likely to offer an excellent deal to buyers on a car that fewer people are looking for currently. In other words, a car shopper trading a 2018 Honda Civic for something else will be much happier with the trade-in appraisal than one with a 2021 Jeep Grand Cherokee.

Car buyers should prepare to shop their trade-in around. It’s slightly more complicated to pull off, but selling your old vehicle to one dealership and buying your new car from a different one may make sense if the final invoice numbers work out in your favor. Use the Kelley Blue Book Instant Cash Offer tool to shop your trade-in vehicle at nearby dealerships. When you let the deals come to you, selecting the best trade-in offer for your situation is easier. Remember, you can always negotiate the offer, and pitting one offer against the other is not unheard of when shopping around for a vehicle.

The Higher Costs of Car Insurance

With tariffs on imported cars and some car parts, it’s likely that auto insurance rates will climb higher, even as car owners are already stretched to their limits on insurance costs. According to the Bureau of Labor Statistics, car insurance costs were 3.1% higher in September than a year earlier. Bankrate says car insurance costs an average of $2,697 a year for full coverage. Full coverage, called comprehensive car insurance, covers natural disasters like wildfires, hurricanes, floods, and accidents. Before you seal the deal and sign anything for a new vehicle, compare quotes for car insurance.

What to Expect: Looking Ahead

New car inventory is slowly rising heading into the end of 2025. Early November numbers showed the number of available new vehicles in the U.S. hitting 2.97 million units, up 4.2% from last month. This number still trails last year’s count by 5.7%. Early 2025 saw inventories dip as buyers rushed purchases ahead of expected tariff-related hikes, while the second half has shown disciplined restocking focused on profitable, high-demand models. EV sales may continue to cool and prices will likely continue rising as automakers contend with tariffs, suggesting the continuing need to balance steady inventory management with smart pricing.

RELATED: Bad Credit Car Loans: Everything You Need to Know

What to Do if You Need a Car Now

If shopping now, look for remaining 2025 models that car dealerships want to sell quickly to make room for the incoming 2026 vehicles. Manufacturers appear to be holding the line on sharply increasing prices due to tariffs, and that’s great news if you’re in the market to buy a new car right now. Before buying:

- Research your options and expand your boundaries if needed.

- Look for deals, especially on 2025 models, as 2026 vehicles continue to arrive on lots.

- Shop ahead for a car loan if you’re not paying cash.

RELATED: Paying Cash for a Car: Consider the Pros and Cons

Editor’s Note: This article has been updated since its initial publication. Renee Valdes contributed to the report.